2025 3rd Quarter Investment Bulletin

Executive Summary

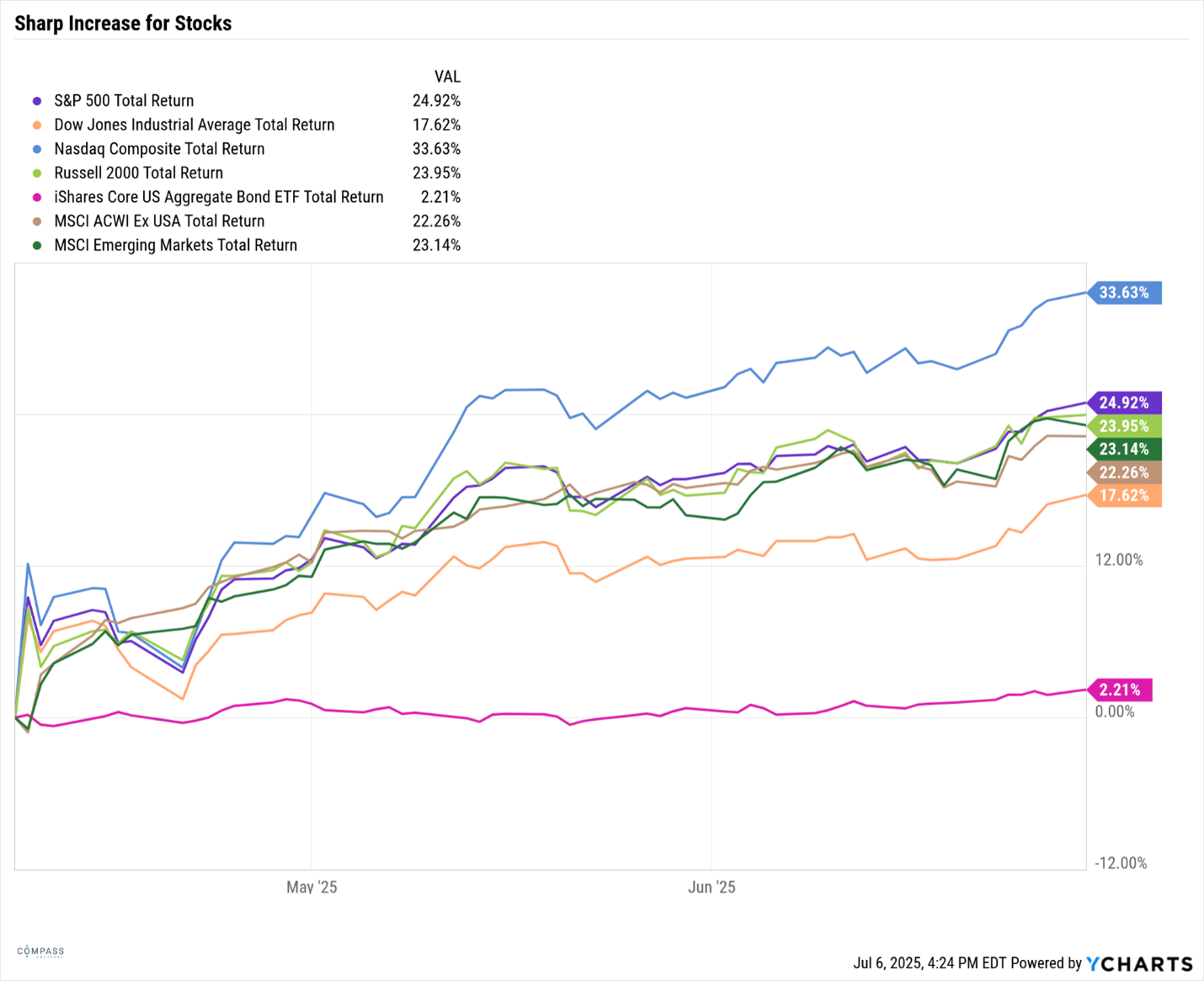

The first half of 2025 was driven by extreme market volatility. The markets, spooked by tariffs, suffered steep losses that reached double digits only to quickly make a dramatic reversal beginning on Tuesday, April 8th.

The rally in stocks strengthened throughout the remainder of the 2nd quarter with the S&P 500 achieving positive gains year-to-date.

Gains during the first half of 2025 favored international markets relative to U.S. equities. This was partially attributable to a 10%+ drop in the U.S. dollar relative to foreign currencies. This is a significant change as U.S. equities have typically outpaced international equities most years.

Bonds are also positive in 2025 as interest rates have drifted slightly lower during the first half.

Quick Reversal from Low to High

The stock market began the year with modest gains, continuing with the general uptrend from 2023 & 2024. However, those gains were quickly unwound as we approached April 1st. Starting April 1st and lasting just a few trading days, the market moved sharply lower. The S&P 500 declined approximately -12% and the Nasdaq fell -20%.

As has been the case in recent years, larger declines have been followed by V-shaped reversals. As you can see from the chart below, 2025 followed the same pattern, strong moves higher across the board with the technology heavy Nasdaq leading the charge.

Tarrifs:

The market has been in a period of calm since the administration announced the pause on the highest tariffs impacting China, the European Union, and Canada. Now that the potential negative impacts on the global economy caused by steep Tariffs has been on the backburner, the stock market has been able to focus on corporate earnings and a generally stable economic picture. Hopefully, the relative calm that exists can continue to move markets higher during the 2nd half of 2025.

Interest Rates:

The Federal Reserve kept its benchmark interest rate steady for the fourth consecutive meeting, with guidance suggesting possible easing later in 2025. The central bank faces a difficult policy tradeoff: tariffs could lead to higher inflation, but they could also slow economic growth if higher prices reduce demand for goods and services. Given the uncertainty, the Fed has held interest rates steady and has reiterated that it wants more data before deciding on interest rate cuts.

Taxes:

The Senate and the House of Representatives have passed a tax and spending bill that was signed into law in early July. The legislation largely extends the provisions of the Tax Cuts & Jobs Act from 2017 which was set to sunset at the end of 2025. Had the legislation been allowed to sunset, provisions such as the increased standard deduction, lower marginal tax brackets, qualifed business income deduction for pass-through entities, the cap on the state and local deductions, and several other provisions would have expired.

Some of the key provisions:

Maintains 7 marginal tax brackets ranging from 10% to 37%.

Standard Deduction for individual taxpayers for 2025 will be $15,750 and for married filing jointly the deduction will be $31,500. These numbers are scheduled to increase with inflation.

Senior deduction is $6,000 per person but has an income phaseout that begins at individual taxpayer income of $75,000 and married jointly income of $150,000.

Pass through deduction for business owners known as Qualified Business Income (QBI) deduction is extended.

The federal estate tax exemption will be set at $15,000,000 per individual in 2026, adjusted for inflation thereafter.

State and local tax deduction (SALT) cap is scheduled to increase from $10,000 to $40,000. There is a phase down for incomes above $500,000.

Provisions for new deductions on Tips, Overtime Pay and Auto loan interest.

Current Outlook & Positioning

We remain cautiously optimistic. We believe markets will rely on fundamental data and that corporate earnings will continue to drive market valuations. We remain fully invested and seek growth in equities and income from bonds as it pertains to each unique client household. We will continue with rebalancing of both sides of that ledger to identify opportunities and manage volatility. As the market continues to make new highs it is critical to partially sell into strength and remain grounded to long-term trends.