2021 3rd Quarter Investment Bulletin

Executive Summary

Stocks rose for the second quarter as the reopening of the economy is fully underway.

Bonds reversed early 2021 losses, but interest rates will be a challenge in the future.

Inflation reignited as a result of economic activity and stimulus.

As the economy recovers, we see upside to the market, but diversification matters.

Stocks Continue to Rise

U.S. stocks gained strength and momentum during the 2nd quarter of 2021. The Wilshire 5000 index which represents all U.S. stocks increased 8.25% to push 1st half 2021 gains above 15%. The latter part of the quarter saw a resurgence in technology and growth stocks which had been lagging value during much of 2021. The tech heavy NASDAQ increased 5.5% in June, and almost 10% for the quarter. Outside of the U.S., gains in international markets continued to be less robust than U.S. stocks. However, international stocks increased a still solid 5% during the quarter.

We expect the market to continue to rise as earnings normalize and unemployment ticks lower. Certain sectors of the market are trading at significant premiums, and we are wary of a return to historical norms. Our portfolio diversification is positioned to seek more attractive pricing opportunities both domestic and foreign.

Bonds Reverse 1st Quarter Losses

The bond market reversed losses from the first three months of the year as interest rates fell throughout the quarter. Bond prices and interest rates move inversely of one another. Therefore, when interest rates rise, bond prices fall, and vice-versa. The 10-year Treasury rate increased .80% during the first quarter from .93% to 1.73% and then fell .28% to 1.45%. Because of inflation and growing economic expansion, it is inevitable that the Federal Reserve will need to raise interest rates which will be a headwind for bonds in future years.

Hedged Stock Allocation Moves Higher

The positions in the index-hedged investments are a way to gain access to the stock market with a layer of downside protection that measures approximately 15% during the year. This portion of your portfolio is designed to achieve a risk/return tradeoff that sits between stocks and bonds. Having the added protection comes with a tradeoff in that market returns are currently capped at approximately 9.5%. The hedged stock allocation in most accounts rose approximately 2.8% during the quarter and just shy of 6% for the first six months.

What to make of Inflation

The vaccination rollout in the United States picked up momentum in February and March of this year leading to a rapid reopening of our economy. The upward thrust in economic activity has led to surging inflation that is receiving a lot of attention from the media, market participants, policymakers, and politicians. The debate has raged about whether inflationary pressure is a transitory issue caused by the reopening of our economy, or a longer lasting issue to be very concerned about.

The areas that prices are rising most dramatically as measured year over year from June 2020 to June 2021 are the following:

Energy prices have increased 25%

Used cars and trucks have increased 45%

New vehicles have increased 5%

Transportation services such as airfare have increased 10%

We are not dismissive about the potential negative impact of long-term inflation, but at this point in time it seems to us that most of the inflationary pressure is a result of an economy that was mostly sheltered in 2020 rapidly coming to life in 2021. The demand for energy and leisure travel has skyrocketed as Americans resume traveling by air and car. There are a variety of factors causing the increase in automobile prices. The used car pricing seems likely to fade away as time goes on and rental car companies resume selling into the market as leisure travel slows down. The surge in new car pricing is a bit more worrisome as much of the increase is related to a supply shortage in semiconductor chips.

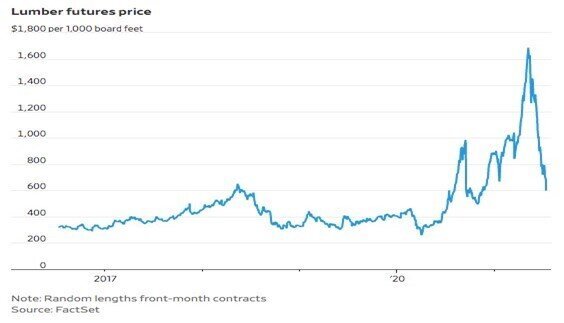

The price of lumber also saw a massive increase in price early this year only to see a corresponding price decline as the supply chain reset. We believe this type of risk and fall is likely to be the case in those other items experiencing surging prices.

Overall as the economy recovers and earnings expand, we see continued upside to the market. Stock valuations appear historically lofty, but we are diversifying to other areas of the market where values are more attractive.